Parts of Medicare

Medicare, the federal health insurance program for individuals aged 65 and older, as well as certain younger individuals with disabilities, is structured into four main parts: Part A, Part B, Part C, and Part D. The complexity of these parts can be confusing for many newcomers to Medicare, but breaking down each part can help clarify their distinct purposes and functions.

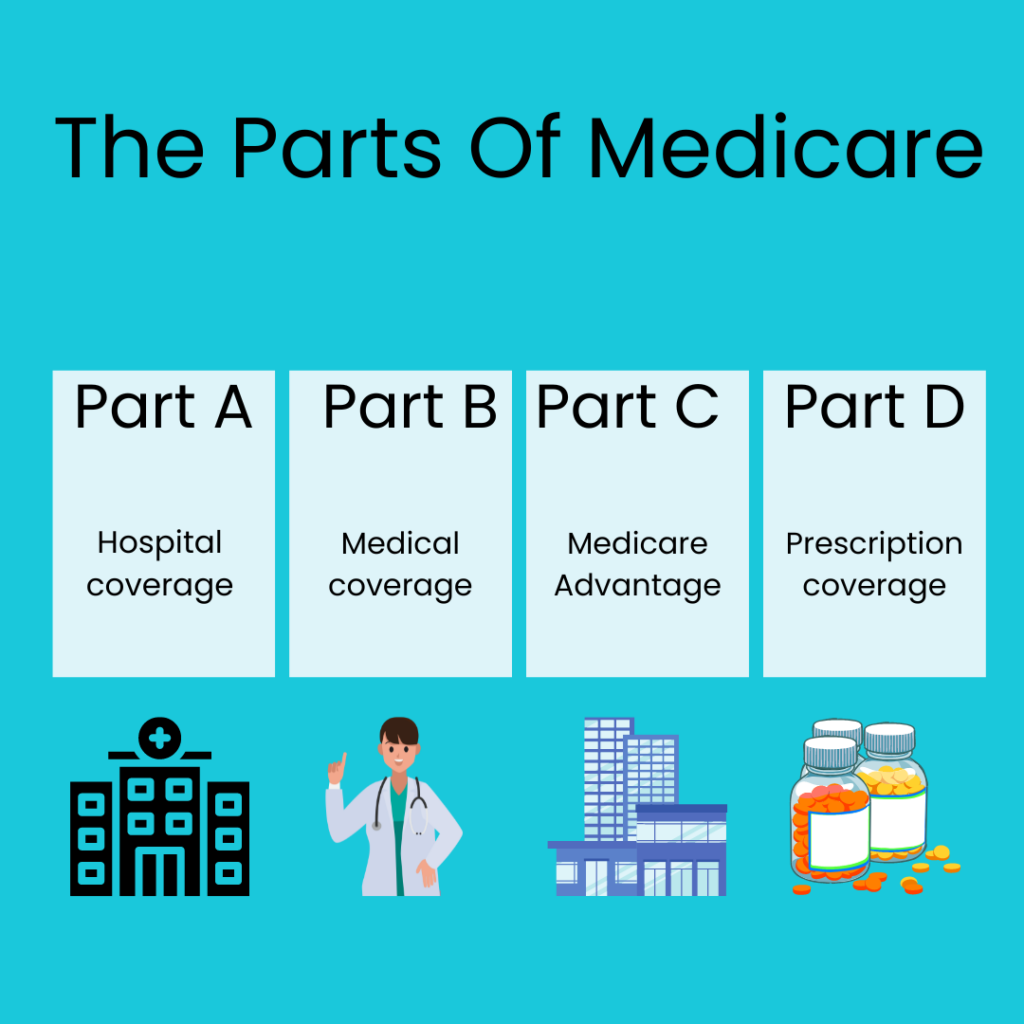

What are the 4 parts of Medicare?

Medicare is broken out into four parts.

- Medicare Part A – Hospital Coverage

- Medicare Part B – Medical Coverage

- Medicare Part C – Medicare Advantage

- Medicare Part D – Prescription Drug Coverage

The parts of Medicare cover different services:

Medicare Part A: Hospital Insurance

Medicare Part A, often referred to as hospital insurance, covers various hospital-related expenses. This includes the cost of a semi-private room during a hospital stay, hospice care, home health care, and stays in skilled nursing facilities. Part A also covers blood transfusions requiring more than three pints of blood.

One significant aspect of Part A is that it is typically free for most individuals who have worked at least 10 years in the United States or are married to someone meeting these criteria. Part A is often likened to covering your “room and board” in the hospital, providing for essential services during an inpatient stay.

While some individuals may consider relying solely on Part A, it’s essential to understand that many hospital procedures and services fall under another part of Medicare—Part B. Therefore, enrolling in both Part A and Part B is crucial unless other coverage is coordinating with Medicare.

Medicare Part B: Outpatient Medical Services

Medicare Part B is designed to cover outpatient medical services that are deemed medically necessary. This includes doctor office visits, lab testing, diagnostic imaging, preventive care, surgeries, ambulance rides, chemotherapy, radiation, and extensive dialysis care for individuals with renal failure. Although some of these services may occur in a hospital, they are categorized under Part B because they are provided by physicians.

Part B is a crucial component of Original Medicare, working in conjunction with Part A. Individuals who choose Original Medicare will sign up for both Part A and Part B at the Social Security office or Railroad Retirement Board.

Understanding the distinction between inpatient (Part A) and outpatient (Part B) care is vital for making informed decisions about Medicare coverage. For those for whom Medicare is the primary or sole coverage, enrolling in Part B is a necessity to ensure comprehensive medical coverage.

Medicare Part C: Medicare Advantage

Medicare Part C, also known as Medicare Advantage, introduces an additional layer of complexity. Unlike Parts A and B, which directly cover specific medical benefits, Part C is essentially a term for private Medicare insurance. Established through the Balanced Budget Act of 1997, Medicare Advantage plans are private health plans that individuals can choose instead of Original Medicare.

Medicare Advantage plans consolidate coverage from Part A, Part B, and sometimes even Part D into a single insurance package provided by a private carrier. These plans often have networks of healthcare providers, and while they may offer lower premiums than Medigap plans, individuals may encounter higher copays over time.

Before enrolling in Medicare Advantage, it’s crucial to weigh the differences between Medicare Advantage and Medicare Supplement (Medigap) plans. This decision involves choosing one type of coverage over the other, necessitating a thorough understanding of how each type functions and the associated costs.

Medicare Part D: Prescription Drug Coverage

Medicare Part D addresses the need for prescription drug coverage. Unlike Parts A and B, individuals do not enroll in Part D through the Social Security office. Instead, they choose a Part D plan from private insurance carriers in their county.

Part D plans, while optional, provide essential coverage for retail prescription drugs. Enrollees pay a monthly premium to the insurance carrier, and in return, they receive significantly lower copays for medications than they would without Part D coverage.

Understanding the rules for enrollment and dis-enrollment in Part D plans is crucial, as there are specific timeframes for making these decisions. Visiting the Medicare Part D section of the website can provide more details on how drug coverage under Medicare functions.

Want Personalized Help with your Medicare Parts?

Our friendly agents can walk you through these 4 parts of Medicare until you understand them well. Our team is very experienced at explaining Medicare parts and how they work. You’ll soon be an expert on different parts of Medicare and what they cover. Reach out to us today!

The Medicare program comprises Part A, B, C, and D. It's important to note that Part C, D, and Medigap plans are offered by private insurance carriers, not the federal government.

You can opt for both a Medigap plan and a Part D plan, or you can choose an Advantage plan, only if you are enrolled in Medicare Part A and Part B.

Many people confuse the terms Parts and Plans. There are only 4 Medicare Parts.

The distinction between Medicare Parts and Plans is a common source of confusion. There are specifically four Medicare Parts.

Contrary to these, the other letters correspond to Medigap plans. Medigap plans serve as optional supplemental coverage, offering the opportunity to fill in the gaps in Medicare. Enrollment in these plans doesn’t occur at the Social Security office; instead, individuals choose their supplemental coverage after joining Medicare and receiving their new Medicare card in the mail. Our agency specializes in assisting individuals in selecting the appropriate supplemental and drug plan options. It’s important to note that our service is provided free of charge.

Have any questions?

Faq Questions

Faq Questions

Have any questions And answers

What is insurance ?

Insurance is a contract between an individual or an organization (the policyholder) and an insurance company, where the policyholder pays a premium in exchange for protection..

What is the purpose of insurance ?

The purpose of insurance is to protect individuals, businesses, and other entities from financial losses due to unexpected events or accidents. Insurance provides a way to transfer the risk of loss..

How does insurance work ?

Insurance works by pooling together the risks of many individuals or organizations and distributing the financial costs of unexpected losses among the members of the pool. Insurance companies..