Medicare and Employer Insurance Coverage

While the typical retirement age falls between 66 to 67 years old, Medicare becomes accessible to most individuals at the age of 65. Individuals who choose to continue working beyond the age of 65 may still benefit from employer-provided group health plans.

This dual scenario of having both Medicare and a group health plan post-65 allows for a coordinated approach to address healthcare needs and associated costs, including insurance for retirees. This article delves into the dynamics of employee health coverage, the interplay between Medicare eligibility and group health plans, and considerations regarding coverage and expenses for individuals navigating both insurance options, including insurance for retirees.

Medicare and employer health insurance can work together seamlessly to ensure comprehensive coverage for individuals, especially those who continue working past the age of 65. Understanding how these two insurance plans complement each other, the rules for enrollment, the implications for Health Savings Accounts (HSAs), and the impact on spousal coverage is crucial for making informed decisions about healthcare benefits.

Medicare and Employer Insurance Integration

Original Medicare, consisting of Parts A and B, offers extensive hospital and medical coverage, similar to many employer health plans. The intention is not for one to replace the other but for them to work in conjunction. The objective is to create a comprehensive safety net that addresses healthcare needs and helps manage medical expenses effectively.

When an individual is eligible for both Medicare and employer-provided group health insurance, the two plans can coordinate to cover medical costs. This integration becomes particularly relevant for individuals who choose to work beyond the age of 65, the typical age of Medicare eligibility.

Enrollment Choices and Penalties

The decision to keep employer health insurance with Medicare depends on various factors, including the size of the employer’s company. The rules for choosing between employer health benefits and Medicare are as follows:

- For employers with fewer than 20 employees, enrolling in Medicare upon eligibility is necessary to avoid late enrollment penalties for Part B later on.

- For employers with 20 or more employees, individuals can delay Medicare enrollment without incurring penalties.

These rules also apply to individuals under 65 who are eligible for Medicare due to a disability. It’s important to note that if someone is still covered by group health insurance at the age of 65, the same rules apply.

Upon retirement and the cessation of employer health benefits, individuals have an eight-month special enrollment period to sign up for Medicare Parts A and B without late enrollment penalties if they followed the rules during their employment.

While it is possible to decline Medicare, this decision requires a complete withdrawal from Social Security or Railroad Retirement Board benefits and repayment of any benefits received.

Primary and Secondary Payer Dynamics

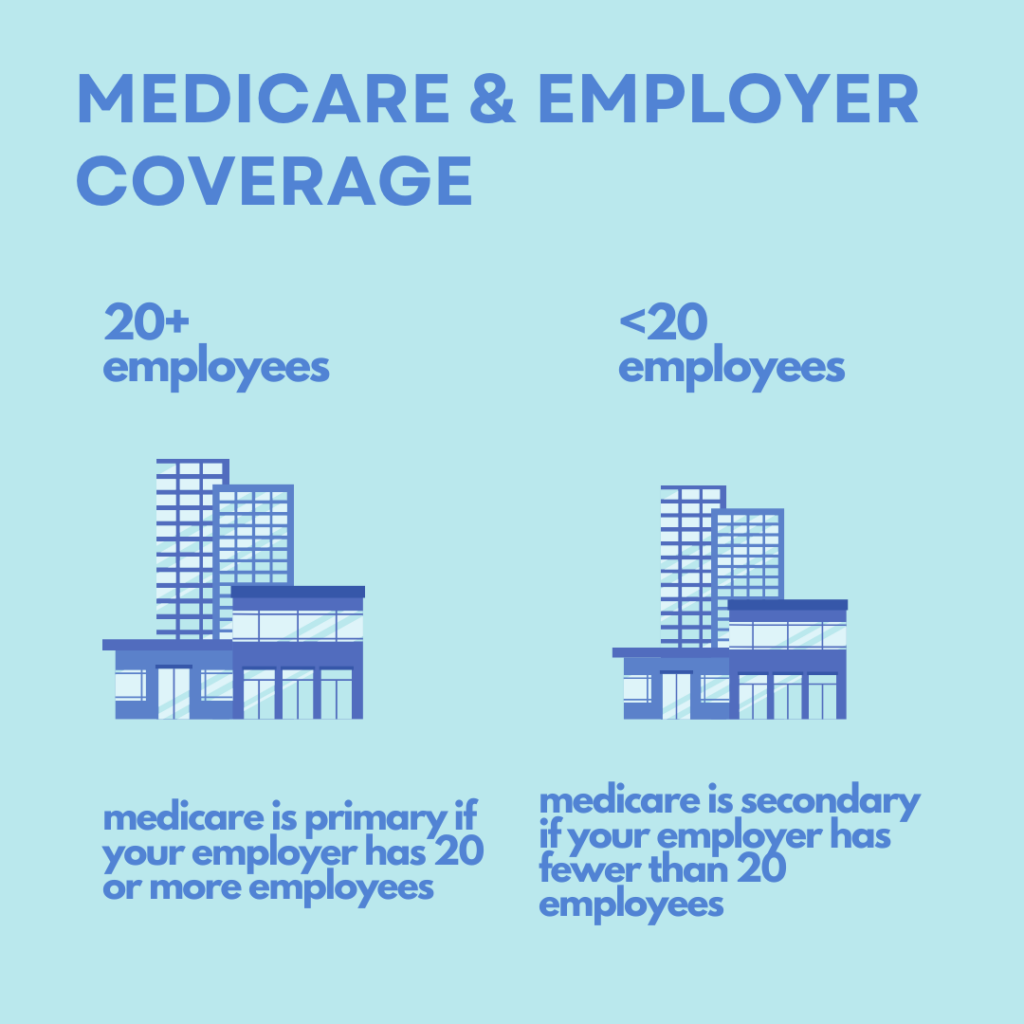

Understanding the dynamics of primary and secondary insurance coverage is crucial. The determination of whether Medicare is the primary or secondary payer depends on the size of the employer:

- Medicare is the primary payer for employers with fewer than 20 employees. However, it becomes the secondary payer if the employer is part of a group health plan with larger employers.

- For employers with 20 or more employees, the group health plan is the primary payer, and Medicare serves as the secondary payer.

While these rules provide a general framework, individual circumstances may alter the dynamics. For personalized guidance, individuals can contact the Centers for Medicare & Medicaid Service’s Benefits Coordination & Recovery Center.

Impact on Health Savings Accounts (HSAs)

Medicare’s interaction with Health Savings Accounts (HSAs) is a critical consideration. Individuals on Medicare cannot contribute to an HSA. If someone is 65 years or older, Part A coverage can start up to six months before the enrollment date, potentially leading to tax penalties if there is an overlap with HSA contributions.

To avoid penalties, individuals and their employers should cease HSA contributions six months before retirement or applying for Social Security or Railroad Retirement Board benefits, especially when considering insurance for retirees. A special enrollment period may be available for those with a high deductible health plan and an HSA, allowing them to sign up for Part B without penalties.

Despite Medicare’s restrictions on contributions, HSA funds remain usable for qualified medical expenses, such as deductibles, premiums, coinsurance, and copayments.

Spousal Coverage Considerations

It’s essential to recognize that Medicare is individual health insurance coverage, and it does not extend benefits to spouses or dependents. In contrast, most group health plans include coverage options for dependents and spouses.

If an employee receives both Medicare benefits and employer benefits, Medicare coverage only applies to the employee. Dependents or spouses do not receive Medicare benefits, even if the original group health plan covers them. Separate eligibility rules for spouses should be taken into account when evaluating overall health plan enrollment decisions.

What Happens if You Retire and Later Return to Work?

If you decide to retire and subsequently return to work, questions often arise about the implications for Medicare coverage, especially regarding insurance for retirees. If you retire, enroll in Part B, and later re-enter the workforce with employer insurance, you have the flexibility to cancel Part B during your employment. When you retire once more, a second 6-month Open Enrollment window opens, allowing you to obtain a Medigap plan without facing health-related inquiries. This provides individuals with the opportunity to adjust their Medicare coverage based on their changing employment status, including exploring options for insurance for retirees.

Expert Guidance For More Information

Are you seeking help to get clarity on your healthcare coverage choices? Allow our team of experts to guide you in understanding your basic benefits, and then we can assist you in selecting the right supplemental plan. Reach out to us today!

The Medicare program comprises Part A, B, C, and D. It's important to note that Part C, D, and Medigap plans are offered by private insurance carriers, not the federal government.

You can opt for both a Medigap plan and a Part D plan, or you can choose an Advantage plan, only if you are enrolled in in Medicare Part A and Part B.

Have any questions?

Faq Questions

Faq Questions

Have any questions And answers

What is insurance ?

Insurance is a contract between an individual or an organization (the policyholder) and an insurance company, where the policyholder pays a premium in exchange for protection..

What is the purpose of insurance ?

The purpose of insurance is to protect individuals, businesses, and other entities from financial losses due to unexpected events or accidents. Insurance provides a way to transfer the risk of loss..

How does insurance work ?

Insurance works by pooling together the risks of many individuals or organizations and distributing the financial costs of unexpected losses among the members of the pool. Insurance companies..